FAQ

FAQ Land Trust (Title Holding Trust)

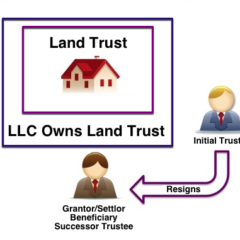

The Advantages and Benefits of Using a Title Holding Trust or Land Trust The Title Holding Trust or Land Trust is a device for acquiring, holding, managing and selling real estate. It is a more desirable and advantageous ownership structure than some of the more familiar forms of real estate ownership. Title to real estate […]

FAQ Funding

Welcome to the funding section! A lot of people think about funding where they need great credit and they need good amount of money down and it’s very difficult. There’s a saying in real estate investing: If you have a great deal you can find the money. Let’s just talk about funding and keep it really simple, especially […]

FAQ No Equity Houses

FAQ No Equity Houses I hear all the time how do I make money if there’s no equity in the house? Well here’s a couple of ideas: You can buy the house subject to the existing financing with the Land Trust if the house is in a good location and if the house is in […]