Various strategies using real estate options to reduce mortgage debt and build wealth. Options are presented as a tax-advantaged alternative to traditional mortgages, allowing for leveraged investments with deferred tax liabilities. Several case studies illustrate how options can be employed in various scenarios, including nothing-down purchases, lease-option agreements, and syndication with multiple investors. The author emphasizes the potential […]

FAQ Options – Using Options to Create Sales Audio FAQ How to use creative real estate sales strategies using lease options, particularly in slow markets or with buyers facing financial challenges. Several case studies illustrate how lease options benefit both buyers and sellers, allowing for flexible financing and building equity. Various lease option structures, including […]

Negotiating with home sellers is a key skill. Without this skill you can’t really do well in the terms side of the business. NLP is neuro linguistic programming, it’s an unusual skill that not too many people have, Also, the term “soft skills” are taught in Business School and investment advisory training.

This post explains how to identify motivated sellers by analyzing newspaper advertisements and legal notices, focusing on those facing financial difficulties or management challenges. details strategies for negotiating favorable option contracts, emphasizing creative structuring to benefit both buyer and seller. Specific negotiation dialogues and examples illustrate techniques for securing advantageous terms, including minimizing risk and […]

Notes – Seller Carry – Tom Henderson Real Estate Note FAQs What is a seller carry back note? A seller carry back note is created when a seller finances part of a property’s sale price for a buyer. The buyer makes regular payments to the seller, similar to a traditional mortgage. This arrangement can benefit both parties: buyers may obtain financing when traditional options aren’t available, and sellers can potentially gain an additional income stream. How does a seller carry back note differ from a traditional mortgage? While similar in structure, seller carry back notes originate from the property seller, not a lending institution. This provides flexibility in terms and conditions, allowing for tailored agreements to fit both the buyer and seller’s needs. What is a security instrument in a seller carry back note? A security instrument safeguards the seller’s interests in a carry back note. It’s a legal document, recorded in the county recorder’s office, establishing the property as collateral for the debt. This instrument, often a Deed of Trust, allows the seller to reclaim the property if the buyer defaults on payments. What are the different ways to structure a seller carry back note? Seller carry back notes offer a wide array of structuring options. These include: Fully […]

Tax Code’s Officially Designed “Rent-to-Own Your Home” Program for Investors and Renters You can realize big benefits with the tax code officially designed “rent-to-own your home” program. This program. known in the tax law as a ”Shared Equity Financing Agreement,” avoids many of the problems with the lease option, yet provides similar income-producing possibilities and […]

FAQ Wholesaling Real Estate Wholesaling FAQ What is wholesaling in real estate? Wholesaling in real estate involves finding properties at a discount, putting them under contract, and then assigning that contract to another investor for a fee. Essentially, you are acting as a middleman, connecting motivated sellers with investors looking to rehab or rent properties. […]

FAQ Sub2 Subject-To FAQ What does “Subject To” mean in real estate? “Subject To” means taking ownership of a property without formally assuming the existing mortgage loan. The loan remains in the original seller’s name and on their credit report. You take title to the property while the seller remains responsible for the debt. Why […]

FAQ IRS Links Retirement IRAs Links https://www.irs.gov/taxtopics/tc451 Tax Topics Complete List https://www.irs.gov/taxtopics Good IRS Contribution Limit Article https://www.cnet.com/personal-finance/investing/2025-retirement-changes-401k-updates-increased-catchup-contributions-and-more/

FAQ Apartments Maximize NOI, Not Occupancy Ellie Perlman Founder and CEO @ Blue Lake Capital | Multifamily Investment Opportunities April 12, 2021 When evaluating the operational strength of our properties, one of the key metrics I look at is NOI (Net Operating Income). A common misconception is that you have to maintain a very high […]

There’s a free section and a paid section and then there is one-on-one coaching. In the free section you get a lot of forms and a lot of videos to be able to get started. In the paid section you get some free courses and then there are some paid courses. The big thing is that […]

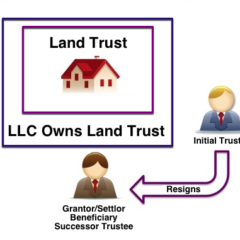

The Advantages and Benefits of Using a Title Holding Trust or Land Trust The Title Holding Trust or Land Trust is a device for acquiring, holding, managing and selling real estate. It is a more desirable and advantageous ownership structure than some of the more familiar forms of real estate ownership. Title to real estate […]

Welcome to the funding section! A lot of people think about funding where they need great credit and they need good amount of money down and it’s very difficult. There’s a saying in real estate investing: If you have a great deal you can find the money. Let’s just talk about funding and keep it really simple, especially […]

FAQ No Equity Houses I hear all the time how do I make money if there’s no equity in the house? Well here’s a couple of ideas: You can buy the house subject to the existing financing with the Land Trust if the house is in a good location and if the house is in […]