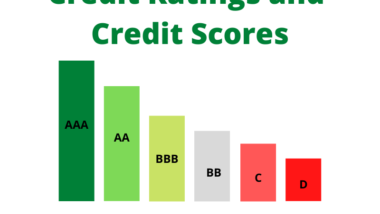

Okay it’s important if you have a business that you have good credit and that you have some credit lines. If you have awful credit There’s Hope!

We can help you get better credit rating.

Keep your job for at least 6 months.

Pull your three credit reports.

If you don’t know how to read your credit reports go down to a bank and ask the banker what the marks mean and they’ll explain it to you. Most of the reports aren’t that hard to understand.

We have a course in repairing credit and then we have a course in building credit.

But here it is in a nutshell.

The Fair Credit Reporting Act is a federal act. It is the law that the credit bureaus have to follow.

If they don’t follow the law, you can complain to the Federal Trade Commission or the FTC, and they can love you a fine of $10,000 or more.

It doesn’t cost any money whatsoever to fix your credit but you need to know what you’re doing.

So here are the steps:

One order your three credit reports

Two find out what’s wrong with them, copy them and highlight the problems.

Three you want to do what’s called a dispute on each Mark with a different letter. You do not want to dispute five things in one letter.

Now that’s a lot of stamps but that’s the way to do it.

And all you have to claim is it’s not accurate. You don’t have to explain why. And you need to state that it’s highly interest to your ability to borrow money and your reputation getting jobs.

And it’s also helpful to state that you know the Fair Credit Reporting Act.

So you might want to say according to the Fair Credit Reporting Act, if I’m asking you to do a reinvestigation of this Mark you have to do that within a timely manner. The date of this letter is June 1st, so I will anticipate to hear back from you within 30 days.