What is a database? A database is a collection of information. Any form on a piece of paper that’s collected, name address phone number, creates a database. Access Beginner 1 The Absolute Beginners Guide to Microsoft Access S M L XL FS | Slo Reg Fast 2x | Bookmark Start Here! Access Beginner Level 1 is the perfect starting place for anyone who needs to learn the basics […]

Originating and Underwriting Learning Center Everything you need to know to assist in originating and underwriting loans for sale to Fannie Mae This Learning Center page provides resources and training on originating & underwriting loans, Fannie Mae’s underwriting applications, and best practices to help you get the most out of Fannie Mae mortgage products, the Selling […]

How I set my fees with least purchase consulting I’m going to presume that you want to be a lease purchase consultant and that’s all you want to do, If you’re in a state California or New York that has pretty strict regulations you might want to get licensed to sell or lease real estate. […]

To find an FHA license mortgage origination underwriter: https://www.hud.gov/program_offices/housing/sfh/lender/lenderlist Standard mortgage application for borrowing money for an FHA mortgage https://singlefamily.fanniemae.com/delivering/uniform-mortgage-data-program/uniform-residential-loan-application NMLS NMLS Consumer Access https://mortgage.nationwidelicensingsystem.org/about/sitepages/NMLSConsumerAccess.aspx About the NMLS https://mortgage.nationwidelicensingsystem.org/about/SitePages/default.aspx CFPB Loan Origination https://www.consumerfinance.gov/compliance/compliance-resources/mortgage-resources/loan-origination-rule/ CFPB Ability to Repay https://www.consumerfinance.gov/rules-policy/final-rules/ability-to-pay-qualified-mortgage-rule/ CFPB Buying a House (for consumers) https://www.consumerfinance.gov/owning-a-home/

Courtesy of www.Nolo.com State Laws on Security Deposit Limits More than half of the states put a limit on how much landlords can charge for a security deposit. By Ann O’Connell, Attorney ● UC Berkeley School of Law Updated 4/11/2024 Most states set a limit on the amount of security deposit landlords can charge. If your state has a […]

Making Money Consulting on lease purchases with both Home Sellers and Home Buyers! I love the Consulting approach with lease purchasing as a business model. Sure wholesaling is okay but when you’re dealing with really pretty houses and great school districts it’s a lot more fun. It’s also a lot more fun to be a […]

Hello everybody and welcome to this particular post about lease options with commercial property. With the advent of problems in the commercial real estate field, people having a hard time buying and selling and getting financing, I find that this article was very helpful in positioning yourself as a lease purchase consultant. If you are […]

Direct mail should be an integral part of your marketing strategy. We’ve found that spending a good amount of money on direct mail can yield a huge ROI. If executed well, direct mailings are often the most effective piece of your marketing campaigns. However, direct mail campaigns can be expensive and a total waste of money if […]

Let us know if we can help your marketing!

One of the things that Real Estate Investors really need is a good contact team. I was very lucky when I started because I work for a very experienced real estate investor. His name was Glenn. He’d been working in real estate investing for 40 years. He was in his 60s. I got a job […]

SDIRA Buy and Hold Real Estate Guide The Step-by-Step Process: Establish a Self-Directed IRA: This is the first step. Not all custodians allow this. You need a specialized SDIRA custodian (like Equity Trust, Advanta, or others) that handles “alternative assets” like real estate. Fund the SDIRA: You transfer or roll over funds from a traditional IRA, 401(k), […]

Unlock Your IRA’s Earning Power: A Guide to Wholesaling Real Estate When you think of a Self-Directed IRA (SDIRA), you might picture stocks or mutual funds. But what if you could use its tax-advantaged power for active real estate investing? The answer is yes—you can even execute wholesale deals entirely within your IRA. This strategy […]

Yes you can buy property in an IRA but it has to be a special IRA call the self-directed IRA that allows you to buy real estate. Ways to fund the transaction: Purchasing outright with your retirement account Partnering account money with another source Leveraging with non-recourse loan

Results 1 – 3 of about 3 for Hard Money Lender . (0.373 seconds) -Hard Money Brokers Hard money brokers are lenders who lend money based on the asset and not on the person borrowing the money. They are also called asset lender financing. Hard money is expensive money because it charges points and higher interest but it is easier than Traditional Bank financing. It […]

Banks can help you get loans and credit cards. It’s important to have a good credit rating and to help other people get a good credit rating. See our financing section for Real Estate Investors.

What are the different types of financing available to real estate investors? Real estate investors have a variety of financing options, including: Bank Financing: Traditional bank loans, suitable for refinancing rental properties or financing retail buyers. Hard Money Lenders: Short-term, higher-interest loans for quick property purchases. Private Lenders: Individuals who lend money for real estate […]

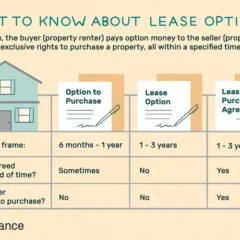

Buyers in real estate investing I. Acquisition Strategy Framework Control-Based Strategies (Minimal Cash Outlay) Lease Purchase/Option Control property with option fee vs. down payment Secure today’s price for future purchase Time to arrange financing while controlling asset Build equity through rent credits Subject-To Existing Financing Take over seller’s existing mortgage payments Acquire property “subject to” […]

What is a land contract? Land contracts have been involved with a way to finance property for over 200 years in the United States. They are still very common today in the Midwest. The history of land contracts came from selling land on installments. Every state has different laws as far as repossessing a property […]

Buying on a land contract When you buy on a land contract you put some money down, you make some payments over time and you have a balloon payment at the end. We use land contracts, contracts for deed, agreements for deed, they’re all the same thing everyday as one of our offers as a […]

Wrap A wrap means a wrap around mortgage. It’s called a wrap because it’s a type of seller financing where the seller agrees to create a brand new mortgage that wraps around the existing financing. The existing financing could be the first mortgage or first and second mortgage. You need to get permission from the […]

What is a short sale? A short sale is where you make an agreement with the bank to accept payment terms, many times are less than what is owed on the mortgage. How does a short sale with the bank affect my credit score? A short sale can have a significant impact on your credit […]

Selling Properties for Cash You can: Sell to another investor for cash Sell to a consumer buyer for cash Sell to an investor, seller carry, take a note for equity, and sell the note at a discount Understand some Tax issues: What the IRS says about Buying and Selling Properties – Dealer Status

Rental Property Taxation FAQ 1. How is rental income taxed? Rental income is taxed as ordinary income based on your IRS tax bracket. For instance, if your rental income is $10,000 and you fall within the 22% tax bracket, you’ll owe $2,200 in taxes on that income. 2. What deductions can I claim for a […]

Negotiating the Deal for an Assignment We assign deals for a fee there are several types of deals that we assign for fee. Wholesale deal, house that needs work, we need to figure out a price that we can assign the paperwork for a fee, But generally wholesaling deals are 65% of the after repair […]

Selling on lease with option compare renting the property out to attend as a landlord, and showing the property on a lease option Sure, let’s compare the two scenarios: Renting the Property Out Landlord Role: As a landlord, you retain ownership of the property and rent it out to tenants. Income: You receive regular rental […]

Land Contract or Contract for Deed Buying or selling on a land contract or contract for deed This means that you put some money down, you get possession, you get Equitable Title but not legal title like a warranty deed, then you make payments over time with generally a balloon payment in the future. It […]