Funding

Welcome to the funding section!

A lot of people think about funding where they need great credit and they need good amount of money down and it’s very difficult.

There’s a saying in real estate investing:

If you have a great deal you can find the money.

Let’s just talk about funding and keep it really simple, especially if you’re not experience at all.

Let’s say you’re a corporate person and you’ve got a corporate job.

let’s say you are a librarian or

let’s say that you are a mechanic.

All of these people don’t have any experience with real estate investing.

Oh sure you may be have experience with being tenant and having a lease, or

being a home owner and having a FHA mortgage.

But unless you’ve been experienced with alternative financing, you don’t really understand real estate investing.

Creative real estate investing has to do with any way you can legally get involved with owning or leasing or occupying property.

Let’s talk about real estate agents for a second.

Real estate brokers hire agents to act for them.

They want them to do exactly what they want them to do.

A good broker will want their real estate agents to do only two things:

- Brokers want their agents listing houses on an exclusive right to sell agreement so that they can earn a commission.

- Brokers want their agents getting an exclusive buyer agreement with bank qualified buyers so they can get a commission.

Another thing:

I have met many Brokers that have told their agents that alternative financing is illegal and we will not going to get involved ANY creative financing in this office.

I don’t know if you’ve heard of Gary Keller but he started Keller Williams in the ’70s. That’s a long time ago that’s 50 years ago.

Keller Williams is in the top three worldwide of traditional real estate agencies. They have some of the best books that an agent or a real estate investor can read. They’re very practical books and extremely action oriented, I highly recommend you get every book that Gary Keller has ever written but I’m going to talk about the book below.

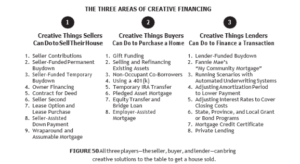

There are a lot of terms in chapter 10 that unless you’re in mortgage financing you don’t understand. But I’m going to put a graphic up here and it talks about three different players creative financing: the seller, the buyer, and the mortgage professional.

As you can see from the graphic, the seller can do things, the buyer can do things, and the mortgage broker can do things. Now a lot of this language doesn’t make any sense to the common person. But we deal with most of this in our business of real estate investing..