Read the IRS info

Installment sale.

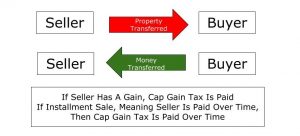

An installment sale is a sale of property where you receive at least one payment after the tax year of the sale. If you realize a gain on an installment sale, you may be able to report part of your gain when you receive each payment. This method of reporting gain is called the installment method. You can’t use the installment method to report a loss. You can choose to report all of your gain in the year of sale.

This publication discusses the general rules that apply to using the installment method. It also discusses more complex rules that apply only when certain conditions exist or certain types of property are sold.

If you sell your home or other nonbusiness property under an installment plan, you may need to read only the General Rules section, later. If you sell business or rental property or have a like-kind exchange or other complex situation, also see the appropriate discussion under Other Rules, later.