– Home Owner in Training

Homeowner and training is a saying for rent to own tenants, as they are preparing get a mortgage, There are three hurdles: DTI which is that to income ratio of 43% Down payment Credit rating To be able to qualify for a mortgage, these hurdles are important to understand. A good resource is at the consumerfinance.gov […]

– Contract for Option vs Option

An option to purchase contract means that you have a right to buy the property anytime during a. Of time for a certain amount of money. This right cannot be taken away from you. Generally you can sell this right by assigning the option, unless it has stated that you cannot assign the contract. So […]

– Negotiating with Renters for Lease Option

Negotiating with Renters for Lease Option Negotiating with renters or tenants for a lease with option take some practice. But it is about positioning… USP USP means unique sales proposition, what are you offering? Decoding Tenant Buyer Positioning: A Guide to “Easy Acceptance” Source: Excerpts from “Positioning Tenant Buyers For Easy Acceptance of Y.txt” Introduction: The […]

– Negotiating the Deal for an Assignment

Negotiating the Deal for an Assignment We assign deals for a fee there are several types of deals that we assign for fee. Wholesale deal, house that needs work, we need to figure out a price that we can assign the paperwork for a fee, But generally wholesaling deals are 65% of the after repair […]

Selling on Lease Option

Selling on lease with option compare renting the property out to attend as a landlord, and showing the property on a lease option Sure, let’s compare the two scenarios: Renting the Property Out Landlord Role: As a landlord, you retain ownership of the property and rent it out to tenants. Income: You receive regular rental […]

– Note

A note is a promissory note, a promise to pay a debt, evidence of a debt. A lot of people think a mortgage is a debt but it’s a security device. So is a deed of trust. To be a legal note, all you need is to identify the parties, who is paying the debt […]

– Mortgage or Deed of Trust

Mortgage or Deed of Trust A mortgage or a deed of trust is a security device. It depends on the state that you’re in. 4 pages pdf

Wrap Around Mortgage Course

What is a Wrap-Around Mortgage? A wrap-around mortgage (or “wrap loan”) is a type of seller financing where the seller creates a new, larger mortgage that “wraps” around the existing underlying mortgage. The buyer makes payments to the seller, and the seller uses a portion of that money to continue making payments on the original first mortgage. […]

– Use Payment Servicer

Use Payment Servicer My payment servicer is someone that takes a payment, and then pays others with that payment. When we do seller financing, we’re going to take the payment from the person in the property and then make sure that the mortgage payment and the taxes and insurance are paid and then any balance […]

– Due on Sale – What is it?

Due on sale clause There’s a due on sale clause in a mortgage, A lot of people think it means that the lender is going to foreclose if you don’t do the right things. The lender is going to call the loan due and payable. What it means is the lender has the right to […]

— There is No Due on Sale Jail

“There is no due on sale jail”, this means that if you do a subject to or wrap around mortgage and do not tell the bank, it’s a civil matter, and the bank can call the loan due and payable. We use Land Trusts to be able to do subject to existing financing transactions and […]

Land Contract – Contract For Deed

Land Contract or Contract for Deed Buying or selling on a land contract or contract for deed This means that you put some money down, you get possession, you get Equitable Title but not legal title like a warranty deed, then you make payments over time with generally a balloon payment in the future. It […]

– Like a Car Loan

Like Car Loan A land contract, contract for deed, agreement for deed, these are contracts that are like a car loan. When you buy a car you put money down, you make the payments, then you get the title when you finish the loan. So these contracts are similar, you put money down, you make […]

Sub 2 Purchase Course

Sub2? What is that? Well, sub 2 is short for subject to the existing financing. It is a popular way to buy property without using a bank. We also use Land Trusts. We can couple subject to purchase with a note. This note can be no payments for 5 years and then a balloon payment. Some people are […]

– Sub to the existing financing

Subject-To Real Estate Investing FAQ 1. What does buying a property “Subject To” mean? Buying a property “Subject To” the existing mortgage means taking ownership of the property without officially assuming the existing loan in your name. The loan remains in the seller’s name and on their credit report, but you make the payments. It’s […]

– Not Liable for Loan

Not liable for a loan means don’t sign a personal guarantee, and don’t cosign for anyone. Personal guarantees are nicknamed “PGs”.

– Private Lender Loans

Private Lender Loans We use private lender loans in our business. It’s important to understand self-directed IRAs to get private lender money. Many people have hundreds of thousands of dollars in their retirement. It’s important to understand what a custodian is, which is a company that’s approved by the IRS to do real estate investment […]

– Joint Venture Silent Partner Loans

What is the joint venture Silent Partner loan? This is where someone will fund the acquisition of a property and also fund the repair costs of the property and maybe even fund some marketing dollars for the property to resell it. They are what we call a silent funding partner. We only use joint venture […]

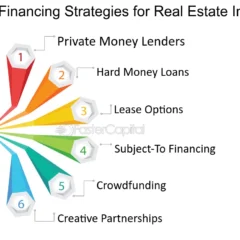

Bank Financing Loans

Bank financing loans have to do with traditional Lending. We know traditional Lending. If you do not have a background in traditional lending we can help. But I would like to make sure that you learn creative financing first before you start getting involved with traditional Lending.

Purchase For All Cash Course

Purchase For All Cash Course This is of course where you learn how to raise all the cash you need. When you make offers they’re all cash and very few contingencies which gets the offer accepted, especially with foreclosures. To be able to purchase for all cash you need to learn some things. One learn about […]

– IRA Loans

An IRA can lend money. In the IRA can earn interest like a mutual fund, Private Lending can help Real Estate Investors receive capital and can help Ira Holders earn steady interest income,

– Find Properties to Flip

Marketing Finding Properties to Flip Everybody has different criteria about finding properties to flip. I think you need the following. And I don’t coach flipping, at coach pretty houses that need no work. Now the properties that I have flipped where I had purchased the property, fixed it up, either lived in it or re sold it, […]