What is a Wrap-Around Mortgage?

A wrap-around mortgage (or “wrap loan”) is a type of seller financing where the seller creates a new, larger mortgage that “wraps” around the existing underlying mortgage. The buyer makes payments to the seller, and the seller uses a portion of that money to continue making payments on the original first mortgage.

Key Characteristics:

-

The original mortgage remains in place and in the seller’s name.

-

The seller acts as the lender for the buyer.

-

The buyer’s payment to the seller covers the payment on the old loan, with the remainder going to the seller as profit.

-

The title is typically transferred to the buyer, but the property serves as collateral for both the original loan (which the seller is still obligated to) and the new wrap-around agreement.

How is it Used in Real Estate Investing?

Wrap-around mortgages are creative financing tools used by investors for several reasons:

-

To Sell a Property Quickly: When a buyer cannot secure traditional financing, a wrap can make the deal happen.

-

To Earn a Higher Return: The seller can set an interest rate on the wrap loan that is higher than the rate on the underlying mortgage, creating a “spread” or profit.

-

To Sell with Equity: If a seller has a significant amount of equity (like in your example), a wrap allows them to pull that equity out over time as monthly payments, rather than as a single lump sum.

-

To Bypass a Due-on-Sale Clause (MAJOR CAUTION): This is the most significant risk. Most modern mortgages have a “due-on-sale” clause that allows the lender to demand full repayment of the loan if the property is sold or transferred. If a seller triggers this clause, they could be forced to pay off the entire underlying loan immediately, which would likely collapse the wrap agreement.

Example: $100,000 House with a Wrap-Around Mortgage

Let’s use the specifics from your query, sourced from www.REISkills.com.

The Existing Situation (Seller’s Position):

-

Home Value: $100,000

-

Balance on Existing 1st Mortgage: $50,000

-

Payment on 1st Mortgage: $450 per month (This payment is based on the original loan’s interest rate and term, which we don’t have, but we’ll use the $450 as given).

-

Seller’s Equity: $50,000 ($100,000 – $50,000)

The Wrap-Around Mortgage Deal:

-

Sale Price: $100,000

-

Down Payment: Let’s assume the buyer makes a $10,000 down payment.

-

Wrap-Around Loan Amount: $90,000 ($100,000 price – $10,000 down payment)

-

Wrap Loan Terms: 8% interest rate, 20-year amortization.

Step 1: Calculate the Buyer’s New Payment

Using an amortization calculator for a loan of $90,000 at 8% for 20 years:

-

Buyer’s Monthly Payment to Seller: $752.72

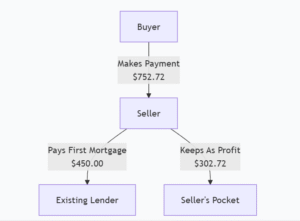

Step 2: Analyze the Seller’s Cash Flow

The seller receives $752.72 from the buyer. From that, they must pay the underlying first mortgage.

-

Payment from Buyer: $752.72

-

Less: Payment to 1st Mortgage: -$450.00

-

Seller’s Monthly Cash Flow (Profit): $302.72

This $302.72 is the seller’s profit, which comes from the interest spread between the low rate on the old loan and the higher 8% rate on the wrap loan.

Step 3: Visualizing the Transaction Flow

Here is a diagram to illustrate the financial flows in this wrap-around mortgage:

Crucial Considerations and Risks

-

Due-on-Sale Clause: This is the #1 risk. The seller must check if their original mortgage has this clause. If it does, the lender could call the loan due when the title transfers.

-

Seller’s Responsibility: The seller is still legally responsible for the original $50,000 mortgage. If the buyer stops paying, the seller is still on the hook for the $450/month payment, or they face foreclosure.

-

Title and Legal Documentation: This is a complex transaction. Both parties must have a real estate attorney draft the promissory note and deed of trust to ensure their interests are protected. The agreement should state what happens if the buyer defaults.

-

Equity Risk for the Buyer: The buyer does not have free and clear title until the wrap-around loan is fully paid off. If the seller defaults on the original mortgage, the lender could foreclose, and the buyer could lose the property even if they were making all their payments to the seller.

In summary, a wrap-around mortgage can be a powerful tool for both sellers and buyers to facilitate a transaction that traditional banks might not support. However, the significant risks, especially the due-on-sale clause, require careful legal review and a high level of trust between the parties.